Construction and real estate businesses deal with unique requirements, regulations, and liabilities. With over 30 years serving the construction industry, we can make sure your business is built on a strong foundation, giving you the ability to grow and succeed.

PROBLEM

The company had just won a job in a foreign country; the problem was that they were exposed to international tax issues that they had not dealt with before. Unfortunately, their previous CPA firm did not have the expertise or resources to help.

SOLUTION

Worried about the possibility of losing the project because of tax issues, they reached out to us at ATA to help prepare them for the international work. Through our resources, knowledge, and BDO USA Alliance membership, we were able to help them get everything they needed to complete the project.

IMPACT

As they were successfully doing international work, it was clear to them they needed a CPA who was still local enough to connect with, but large enough to take their business to the next level.

We are like all small businesses in that we only want to pay the taxes that we owe based on the current laws. ATA has a tremendous amount of experience and knowledge with these laws. They used this experience to help us with our planning to minimize our tax costs.

-John Hale, Bill Adams Construction, Inc.

Contractor's businesses and financial needs are not a "one size fits all" situation. The financial approach that you and your accountant should take should be customized to your individual business and goals. I have over 14 years experience in a wide variety of contractor types and sizes. Due to my experience and knowledge, I am able to quickly identify your individual needs, conduct an efficient audit or review, provide guidance based on your financials, contact the State Contractors Board on your behalf for clarity to any unique situations, and ensure that you submit the needed items timely to meet all outside requirements and deadlines.

-Marcie Williams, Partner

Teachers: Don’t Miss This $300 Tax Deduction

Mar 04 2026

More

100% Depreciation Creates a Smart Window to Upgrade IT Hardware

Feb 18 2026

More

If you’re married, should you file jointly or separately?

Feb 17 2026

More

When Medical Expenses ARE and AREN’T Tax Deductible

Jan 29 2026

More

USPS Postmark Changes Could Impact Time-Sensitive Tax Filings

Jan 29 2026

More

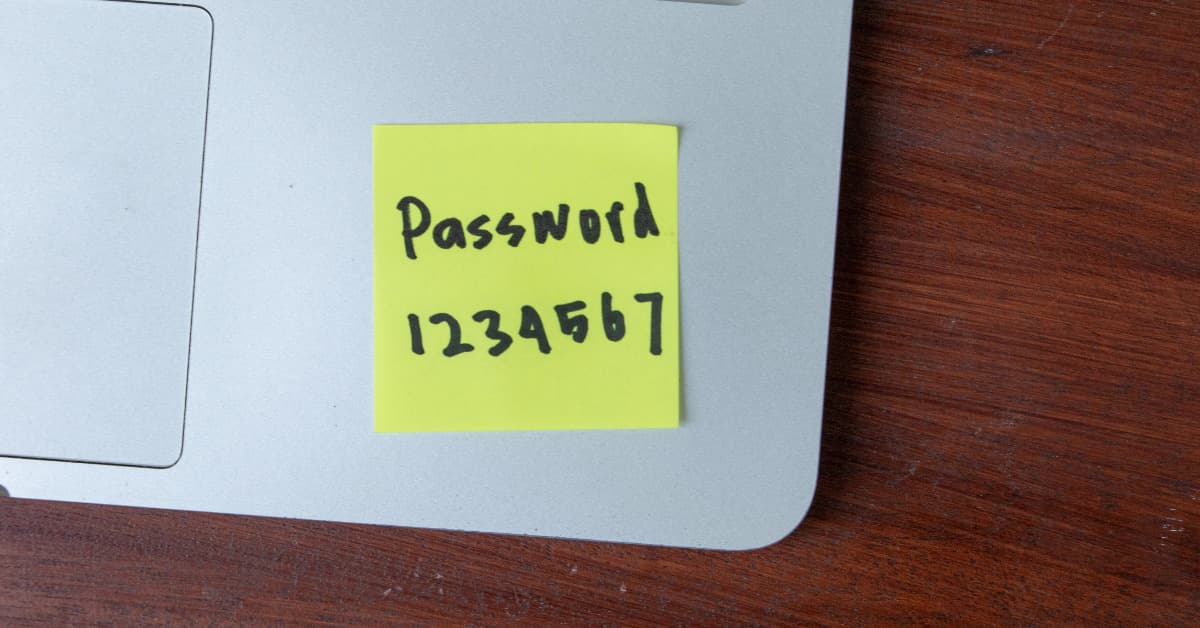

National Change Your Password Day: A Simple Step That Makes a Big Difference

Jan 21 2026

More

Does your board understand the meaning of “fiduciary”?

Jan 21 2026

More

Important: New IRS Rules for 2026 Payroll and Tax Compliance for Tips

Jan 06 2026

More