International tax is the U.S. income tax compliance, tax planning, and tax information reporting for non-U.S. activity and cross-border transactions. Advance international tax planning can help minimize the tax impacts of cross-boarder transactions, and foreign entity restructurings. However, failure to file certain information returns can result in individuals being hit with huge penalties. Therefore, ATA provides insight by identifying risks, ensuring compliance, and assisting with individual and business tax planning for parties that have non-U.S. activity and financial interests.

As a member of the BDO Alliance, we have access to BDO’s full complement of resources, including more than 75,000 international accounting and consulting professionals.

-BDO USA, LLP.

Individuals who have foreign subsidiaries, foreign operations, or are foreign-owned know of the complexities of complying with international tax laws. That's where I can help. With over 20 years of experience in international tax, I have led the international tax reporting and compliance processes for several large multinational companies and assisted in their large-scale tax planning around mergers and acquisitions.

-Jim Duncan, Senior International Tax Manager

100% Depreciation Creates a Smart Window to Upgrade IT Hardware

Feb 18 2026

More

If you’re married, should you file jointly or separately?

Feb 17 2026

More

When Medical Expenses ARE and AREN’T Tax Deductible

Jan 29 2026

More

USPS Postmark Changes Could Impact Time-Sensitive Tax Filings

Jan 29 2026

More

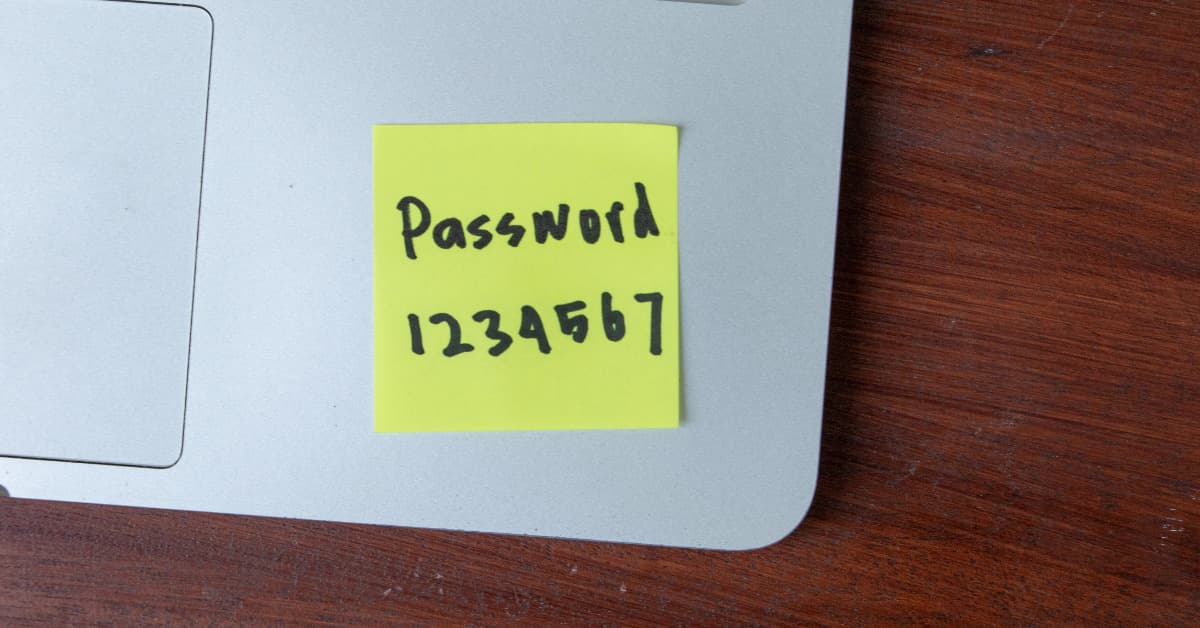

National Change Your Password Day: A Simple Step That Makes a Big Difference

Jan 21 2026

More

Does your board understand the meaning of “fiduciary”?

Jan 21 2026

More

Important: New IRS Rules for 2026 Payroll and Tax Compliance for Tips

Jan 06 2026

More

New Overtime Deduction Rules for 2026

Jan 06 2026

More