How can you increase your efforts as a nonprofit? When you partner with ATA, you bring our experience, expertise, and Family of Firms to your organization. From financial services, to marketing, to creative projects and more, we can help you amplify your influence as a nonprofit.

PROBLEM

Many nonprofit clients have challenges with segregation of duties due to budget constraints. This makes having effective controls more challenging and can result in unwanted findings during an audit because often it is not cost-effective to hire a CPA and the necessary bookkeeping staff. One such nonprofit had annual audits performed but did not have the full-time staffing to have the amount of segregation of duties that was desired. They also wanted assistance with general accounting issues as they arose, such as reconciliations and an experienced CPA to assist with financial reporting and more complex transactions or reporting issues.

SOLUTION

In this case, we had a diversity of resources including staff with bookkeeping, assurance, and tax experience to accomplish the organization’s accounting needs. To hire staff with all the skills needed would not be cost-effective, so this provided a more cost-effective solution.

IMPACT

The benefit of working with us was that ATA had staff devoted to monthly needs, but also the ability to provide personnel for more complex or advanced issues as they arose without the organization hosting excess overhead all year round. As an added benefit during the pandemic, the client now has more resources working with ATA than they would hiring internally and have less risk of their accounting function dwindling due to illness.

Their quick response and sound advice always answer our assurance and accounting needs.

-Dan Stanczak, Sigma Alpha Epsilon

We value our clients' time, and our staff are trained well to make audits swift and seamless. Our team members care about our clients and are passionate about their work. ATA goes above and beyond for clients because we sincerely want the best for them. As a result, we have a solid history of long-term client relationships.

-Cathy Messerly, Partner

100% Depreciation Creates a Smart Window to Upgrade IT Hardware

Feb 18 2026

More

If you’re married, should you file jointly or separately?

Feb 17 2026

More

When Medical Expenses ARE and AREN’T Tax Deductible

Jan 29 2026

More

USPS Postmark Changes Could Impact Time-Sensitive Tax Filings

Jan 29 2026

More

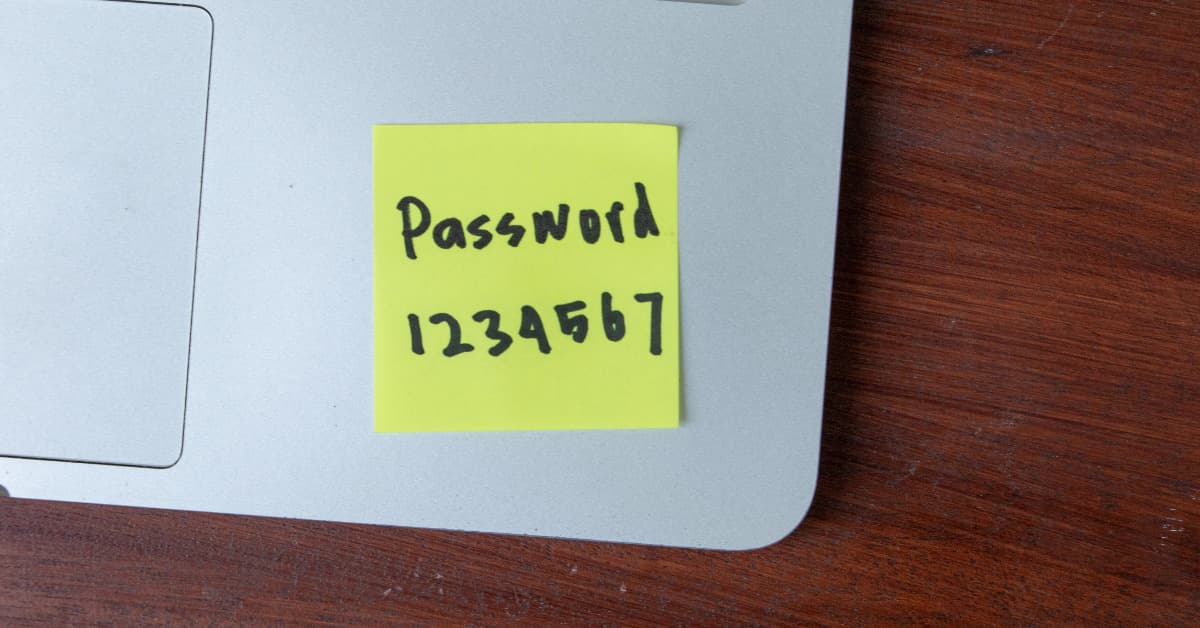

National Change Your Password Day: A Simple Step That Makes a Big Difference

Jan 21 2026

More

Does your board understand the meaning of “fiduciary”?

Jan 21 2026

More

Important: New IRS Rules for 2026 Payroll and Tax Compliance for Tips

Jan 06 2026

More

New Overtime Deduction Rules for 2026

Jan 06 2026

More