Too many taxpayers are not taking advantage of all available opportunities to reduce their taxes. When you work with an ATA professional, you get a trusted advisor who is focused on your needs. We’ll work with you to develop a tax minimization plan consistent with your goals and objectives. The list of questions below may indicate you need some assistance to develop a customized tax plan.

ATA always provides professional expertise and great customer service throughout the tax planning process. I highly recommend their services.

-John Kopperud, John Kopperud Real Estate Agent

All too often, tax laws don't support what our clients want to accomplish. Most advisors would tell the client, "It simply can't be done." At ATA we use our understanding of complex tax rules, coupled with our knowledge of our clients' business and industry type, to find hugely beneficial opportunities. A simple accounting method change saved one of our entertainment clients in excess of $2 million in one year. A knowledgeable tax partner can add enormous value.

-Mark Puckett, Partner

Teachers: Don’t Miss This $300 Tax Deduction

Mar 04 2026

More

100% Depreciation Creates a Smart Window to Upgrade IT Hardware

Feb 18 2026

More

If you’re married, should you file jointly or separately?

Feb 17 2026

More

When Medical Expenses ARE and AREN’T Tax Deductible

Jan 29 2026

More

USPS Postmark Changes Could Impact Time-Sensitive Tax Filings

Jan 29 2026

More

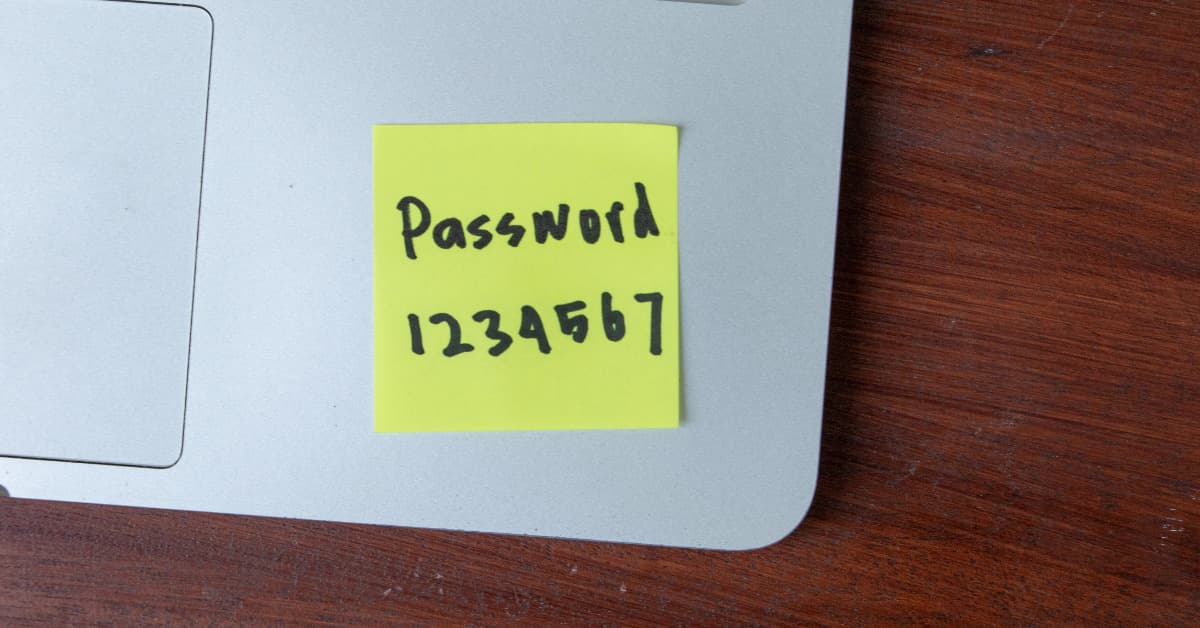

National Change Your Password Day: A Simple Step That Makes a Big Difference

Jan 21 2026

More

Does your board understand the meaning of “fiduciary”?

Jan 21 2026

More

Important: New IRS Rules for 2026 Payroll and Tax Compliance for Tips

Jan 06 2026

More