Easily view the 2024-2025 Tax Planning Guide and navigate through various topics.

Make sure you have all of the important tax dates down in your calendar.

Direct Pay is a new web-based system available on IRS.gov that allows you to pay tax bills and estimated tax payments directly from your bank account without any fees or pre-registration. With this feature, the taxpayer receives instant confirmation that the payment was submitted, and the system is available 24 hours and 7 days a week. This option is only available for 1040s and restricts users’ ability to review payment history or cancel payments.

The Electronic Federal Tax Payment System (EFTPS) is a free service from the U.S. Department of the Treasury. All federal taxes (individual, trust, corporation, etc.) can be paid using EFTPS. This is the same system that businesses use for payroll, income taxes and federal tax deposits. The EFTPS requires users to make an account, therefore allowing them to track or cancel payments.

100% Depreciation Creates a Smart Window to Upgrade IT Hardware

Feb 18 2026

More

If you’re married, should you file jointly or separately?

Feb 17 2026

More

When Medical Expenses ARE and AREN’T Tax Deductible

Jan 29 2026

More

USPS Postmark Changes Could Impact Time-Sensitive Tax Filings

Jan 29 2026

More

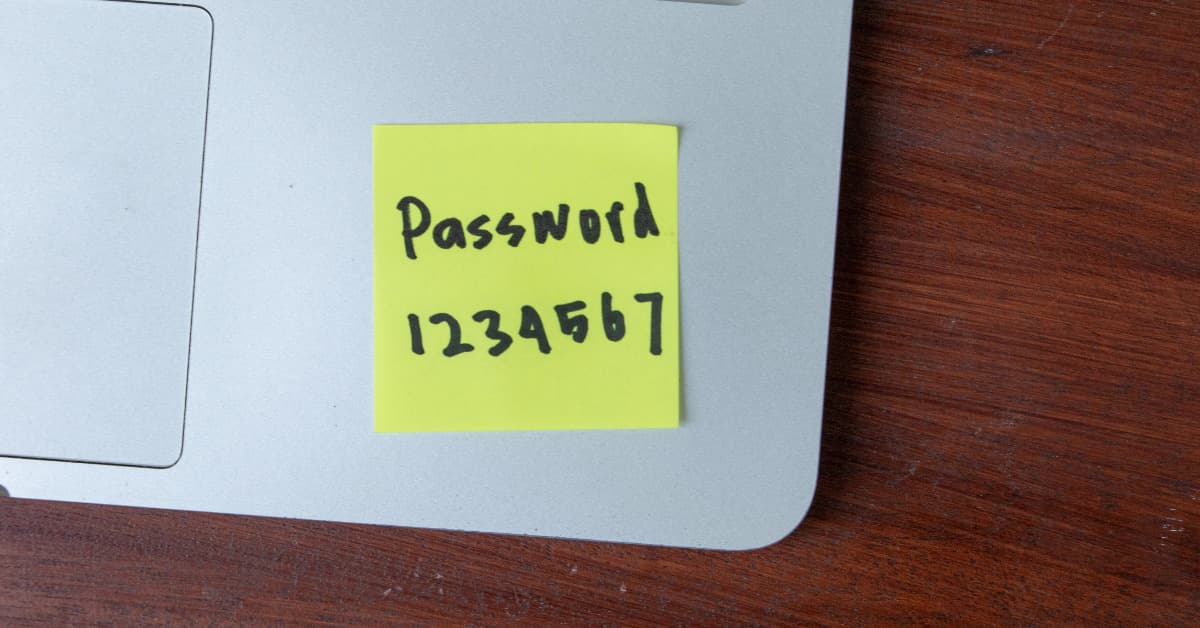

National Change Your Password Day: A Simple Step That Makes a Big Difference

Jan 21 2026

More

Does your board understand the meaning of “fiduciary”?

Jan 21 2026

More

Important: New IRS Rules for 2026 Payroll and Tax Compliance for Tips

Jan 06 2026

More

New Overtime Deduction Rules for 2026

Jan 06 2026

More