Mergers and acquisitions (M&A) and divestitures are critical and strategic transactions. Oftentimes, to optimize the value from these vital transactions requires unique expertise. ATA’s Transaction Advisory practice consists of professionals with unique and diverse skill sets and experience to help you succeed. We understand tight timelines, valuation pricing pressure, and issues identification. In summary, we help companies optimize their transaction outcomes. Our transaction advisory services include:

ATA’s transaction advisory group continues to provide us with value-added insights and solutions related to our various acquisitions as well as our potential selling of the business. We rely on their expertise from a financial modeling, due diligence, enterprise valuation, and negotiation perspective. We highly recommend ATA as companies engage in strategic business transactions.

-CEO, Waste Management Company

In my capacity as the national advisory practice leader at ATA, coupled with my credentials as a certified mergers & acquisitions professional and certified value growth advisor, I continue to see companies struggle with optimizing their business transactions both pre and post deal. Mergers, acquisitions, and divestitures are complex and challenging, and companies need experienced transaction advisors to help them succeed and maximize enterprise valuation.

-Rick Schreiber, Partner and National Advisory Practice Leader

100% Depreciation Creates a Smart Window to Upgrade IT Hardware

Feb 18 2026

More

If you’re married, should you file jointly or separately?

Feb 17 2026

More

When Medical Expenses ARE and AREN’T Tax Deductible

Jan 29 2026

More

USPS Postmark Changes Could Impact Time-Sensitive Tax Filings

Jan 29 2026

More

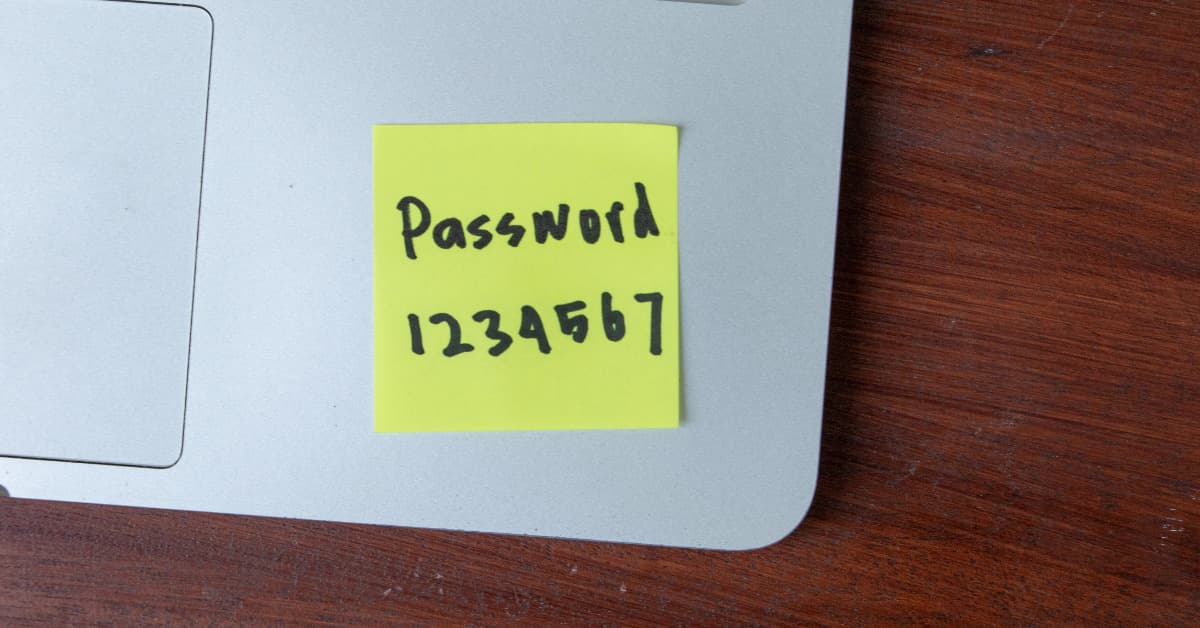

National Change Your Password Day: A Simple Step That Makes a Big Difference

Jan 21 2026

More

Does your board understand the meaning of “fiduciary”?

Jan 21 2026

More

Important: New IRS Rules for 2026 Payroll and Tax Compliance for Tips

Jan 06 2026

More

New Overtime Deduction Rules for 2026

Jan 06 2026

More